What exactly is the definition of sustainable finance? What about ESG? Sustainable investment? What’s the difference – if any – between them all?

In an environment in which solving climate change and growing inequality have become ever more urgent, investing with the aim of making the world a better place is becoming increasingly popular.

To do so, however, requires us to grapple with a blizzard of terminology, taxonomy and acronyms that often seems to obscure more than they illuminate.

An alphabet soup including sustainable finance, ESG, impact investing, corporate social responsibility, green bonds, SASB, TCFD and SFDR represents a daunting learning curve for private investors and event asset managers. Some of these terms are often – wrongly – seen as interchangeable; others overlap in ways that are not always well defined.

Yet the need to understand this new landscape has become pressing. The Covid-19 pandemic has thrown into relief the need for a new approach to investing – and a fresh appreciation of the risks that can arise in an increasingly uncertain and unpredictable world.

“We believe that pandemics and environmental risks are viewed as similar in terms of impact, representing an important wake-up call for decision-makers,” says Jean-Xavier Hecker and Hugo Dubourg, co-heads of sustainability and ESG research for Europe, the Middle East and Africa at J.P. Morgan. “The impacts of the Covid-19 crisis on the real economy and the financial system highlight the limits of most forecasting models.”

Defining sustainable finance and ESG

Many of the topics in this new lexicon are sub-sets of one another – think Russian dolls. More confusing still, the related taxonomy is wide-ranging, and there are many varying definitions of the relevant terminology.

The largest of these is ‘sustainable finance’ or ‘sustainable investing’ which, unhelpfully, are different labels for the same thing – that is, the consideration of environmental, social and governance (ESG) factors when assessing the suitability of a company, activity or fund for investment. These factors essentially trigger three questions:

- Do they really care about the environment?

- Do they really care about people?

- Are those running the company ‘doing the right thing’?

The areas covered will include the following:

Environment: Energy consumption, pollution and generation of waste, use of natural resources

Social: Human rights, community engagement, health and safety of employees and others

Governance: Ethical conduct, transparency and disclosure, executive pay, avoiding conflicts of interest

Various metrics are used to score the performance of a company or an ESG fund in each of these areas. While these include ethical considerations, the main aim of the analysis remains financial performance.

For some institutional investors, particularly pension funds, delivering solid returns to provide beneficiaries with an adequate retirement income is a priority that overrides ESG factors. However, their critics argue that companies ignoring such factors are liable to underperform over time because of their increased exposed to environmental, reputational and legal risks.

They have numbers to support their case. An analysis by Morningstar in 2020 found that sustainable funds outperformed their traditional peers over multiple time horizons, with average five-year returns for Global Large Cap Blend Equity strategies of 7.3% for sustainable funds and 6.1% for traditional vehicles.

Taking these factors into account – a process known as ESG integration – offers asset managers a broader view of a company or fund. But it goes no further than that, and is certainly not prescriptive. Which begs the question: What if ESG integration doesn’t go far enough?

The next step: socially responsible and impact investing

For investors wishing to go further, the next step is Socially Responsible Investing, where a screening process selects certain companies or industries – and actively eliminates others – for a fund or investment portfolio. Elimination may be of entire sectors, such as weapons, gambling, tobacco, pornography or fossil fuels, or relating to the reputation of individual companies, which might be affected by cases of mistreatment of employees, use of child labour or environmental damage.

SRI decisions typically reflect personal values, but political and religious factors can also be the impetus. Meanwhile, a small but growing number of SRI investors are taking a seemingly counter-intuitive approach: investing in companies with problematic businesses in order to drive positive change as shareholders. Known as ‘active ownership’, it can make for interesting AGMs.

If SRI doesn’t go far enough, there’s Impact Investing, sometimes called social impact investing.

Denise Voss, chairwoman of LuxFLAG, Luxembourg’s fund labelling agency, says: “Impact investing…goes even further by choosing companies that are actively seeking to make tangible improvements, for instance in the quality of drinking water for communities. Investors usually expect a profit from such a company, but its impact will be as important or even more so for the impact investor.” That variation in importance is reflected in two key impact investing terms – ‘concessionary’ and ‘non-concessionary.’ The former means that a return is of secondary or no real importance, and is typically the preserve of foundations or high net worth individuals. By contrast, ‘non-concessionary’ means that investors still expect a fair return.

And the debt market?

Like equities, debt instruments also have their place in this new landscape, primarily in the form of green bonds.

These are used to finance or re-finance a specific environment-friendly project such as renewable energy generation, energy efficiency in the home, or pollution-free transport.

A newer, still-smaller market exists for sustainability-linked bonds or loans. These are not tied to a specific project but are used to improve a company’s social and environmental sustainability metrics – such as its greenhouse gas emissions, wastewater discharge or energy consumption.

If the bond issuer fails to meet agreed targets for the metrics, additional payments must be made to bondholders, while the interest rate would rise in the case of a loan.

The spectre of greenwashing

Inevitably, not everything runs smoothly in ESG investing. Greenwashing, where companies give a misleading impression of their ESG credentials, represents a genuine risk for asset managers and investors.

Some companies may conceal information, or lie outright to investors, about their corporate sustainability. But grey areas are an even bigger problem.

Is it appropriate, for example, to invest in a green bond issued by a fossil fuel producer seeking to fund the launch of smart meters, or an authority that wants to build a new, more energy-efficient airport?

Among the reasons why investors often accept such purposes as green is the lack of a universally accepted standard framework for companies to report on ESG metrics.

In a paper Four Things No One Will Tell You About ESG Data’, George Serafeim of Harvard Business School and Sakis Kotsantonis of KKS Advisors noted “the sheer variety, and inconsistency, of the data and measures, and of how companies report them.”

Citing more than 20 different ways that companies report employee health and safety data, they argue that “such inconsistencies lead to significantly different results when looking at the same group of companies.”

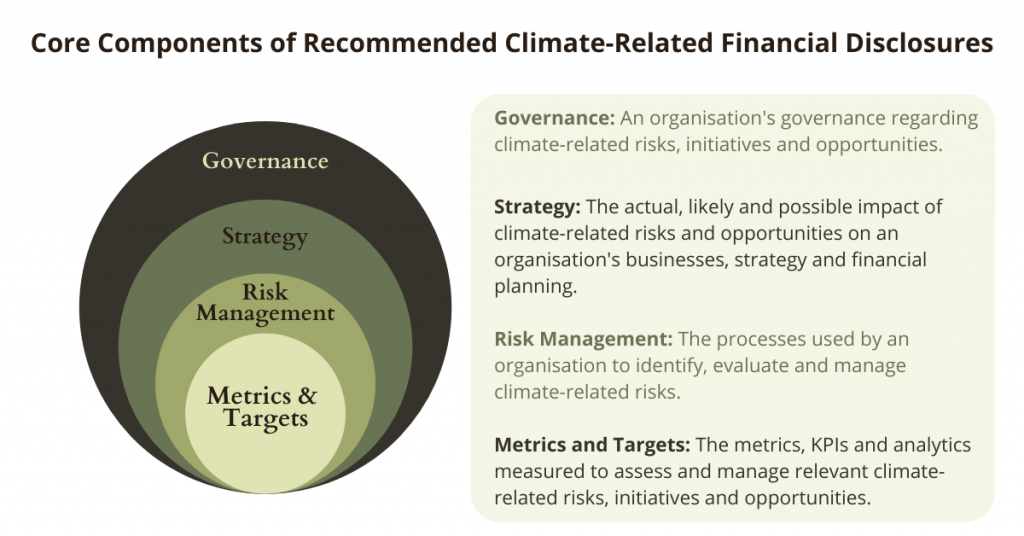

Fortunately, there is hope for improvement here, too. The Sustainability Accounting Standards Board (SASB) has developed standards for companies to disclose their sustainability performance, while the Task Force on Climate-Related Financial Disclosures (TCFD) provides a framework for reporting on climate risk.

BlackRock, the world’s largest asset manager, now expects the companies in which it invests in to use both. Asset managers in Europe now must comply with the Sustainable Finance Disclosure Regulation (SFDR), which imposes new transparency and reporting requirements on asset managers. The EU’s green finance taxonomy will be finalised soon to provide what is intended to be a standardised set of definitions of eligible activities.

ESG investing is bringing rapid change to the asset management industry. Despite the complexity and at times confusion of the various strands of sustainability, firms have no choice but to keep up.