Sustainability has been rising steadily up the to-do list of Europe’s fund industry for several years. But in 2020, as speakers at last month’s ALFI Rentrée conference made clear, ESG has become a priority in market segments ranging from exchange-traded funds to private equity. So what can we expect from sustainable funds?

In recent years, sustainability – a concept often used interchangeably with environmental, social responsibility and governance inputs into investment processes and operations – has been a regular theme of ALFI’s fund industry conferences and other deliberations on the future of the sector.

Like Ernest Hemingway’s line about how a character went bankrupt, its move from the sector’s periphery to its mainstream has come gradually, then suddenly.

It’s not easy to pinpoint exactly when sustainably shifted from a desirable option for ideologically engaged (or conscience-stricken) investors to a critical element in risk-return equations.

But the steady drumbeat of mostly dismal news about global warming has certainly helped.

So has evidence that tolerating mistreatment of employees or misuse of natural resources and habitats, even far down the supply chain, can lead to rapid, devastating and costly reputational damage, fanned by social media

And this year’s collapse of one-time German stock market darling Wirecard is merely the latest, particularly graphic illustration of how corporate governance failings are a red flag often signalling imminent investor losses.

Sustainable funds through the regulatory pipeline

Environmental and broader sustainability requirements for the financial services industry have been flowing through the legislative and regulatory pipeline for some time, especially in Europe. Now they are at hand, from reporting requirements on climate-related risks for investment funds and pension schemes to the EU’s Taxonomy Regulation, centrepiece of the European Commission’s sustainable finance action plan, which took effect in July.

But the shift toward sustainability has been accelerated by the ‘black swan’ of the Covid-19 pandemic. That includes evidence that destruction of natural habitats has heightened our vulnerability to virus-borne diseases, but also the perception that the economic reconstruction offers an opportunity to incorporate environmental and social concerns into long-term planning decisions.

It’s against this backdrop that speakers at last month’s ALFI Rentrée digital conference underlined how far sustainability has seeped into the outlook, strategies and practices of the fund industry, ranging from UCITS retail funds to long-term private equity investments.

Luxembourg’s ambitions writ larger

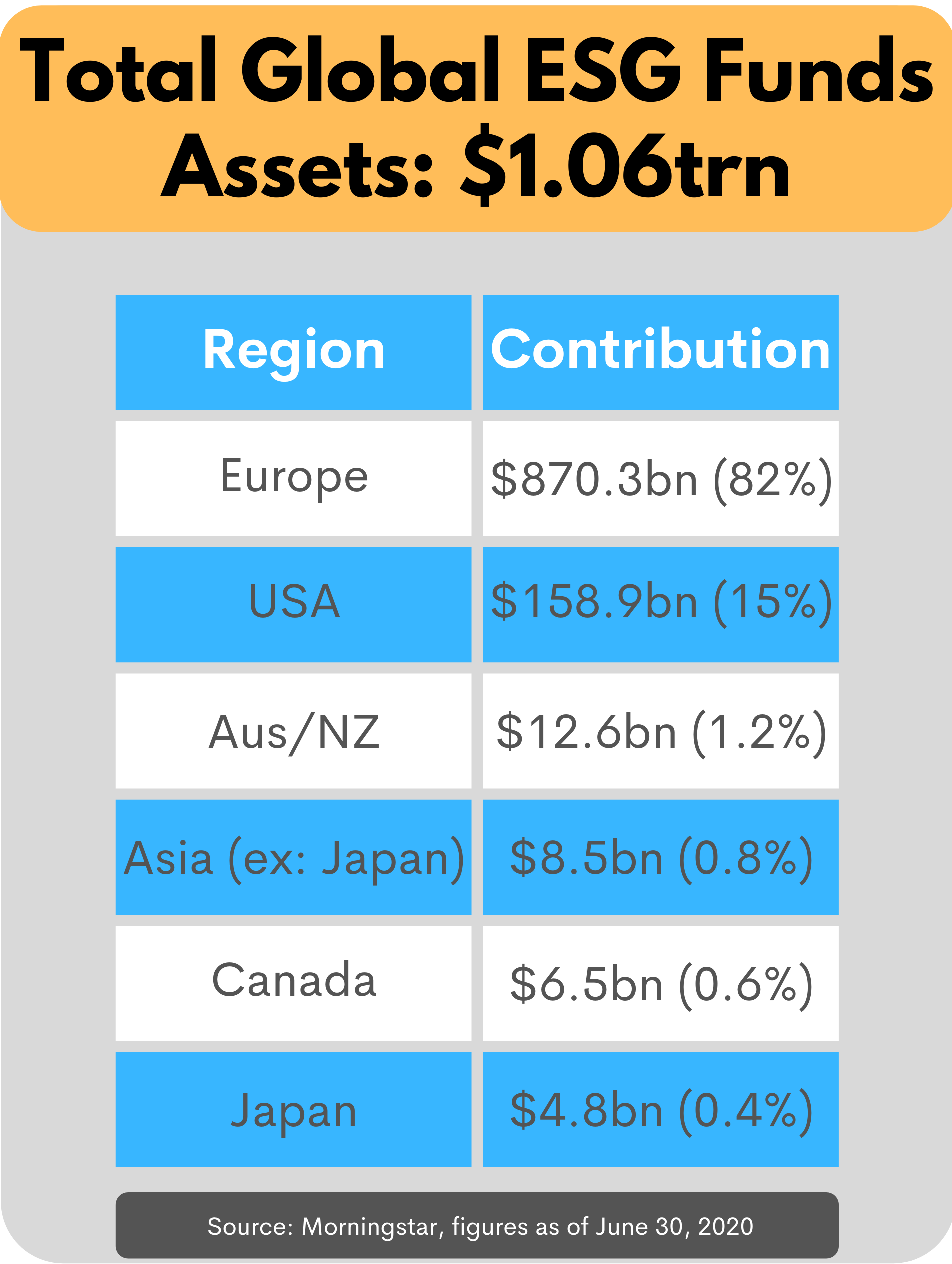

One person who needs no convincing is Claude Marx, CEO of the grand duchy’s financial regulator CSSF. He told conference participants: “Luxembourg’s fund industry has nearly €5 trillion in assets. If just 20% is placed in sustainable investments, €1 trillion, that will definitely place us on the map as a centre of the European Green Deal. It would present organisational challenges, but it’s definitely achievable.”

The government also says it’s committed to making Luxembourg a sustainable investment hub.

Finance minister Pierre Gramegna pointed out that in September the state launched the first sustainable – as opposed to green – sovereign bond to be issued by an EU member state or a triple-A rated country. Proceeds from the €1.5 billion bond, which was more than 10 times oversubscribed, will fund spending aligned with the United Nations’ Sustainable Development Goals.

Meanwhile, the Luxembourg Stock Exchange has just unveiled the LGX DataHub, a centralised database for green and sustainable bonds that will structure currently unstructured data and by year-end cover the entire sustainable bond universe.

Luxembourg’s ambitions mesh with the success of the EU in establishing itself as a standard-setter in sustainable finance. Pablo Portugal, director of the Association for Financial Markets in Europe, noted that this is one of the successes of the otherwise unfinished strategy to create an EU Capital Markets Union.

“The EU has become a global regulatory and market leader, for example with the adoption of the Taxonomy Regulation,” he said. “Several member states have led the way with ESG bonds in response to Covid-19.”

Passing the test

At the onset of the pandemic, sustainable investment advocates worried that a desire for returns from any source might become a higher priority – and that governments might abandon green ambitions for fear of complicating economic recovery.

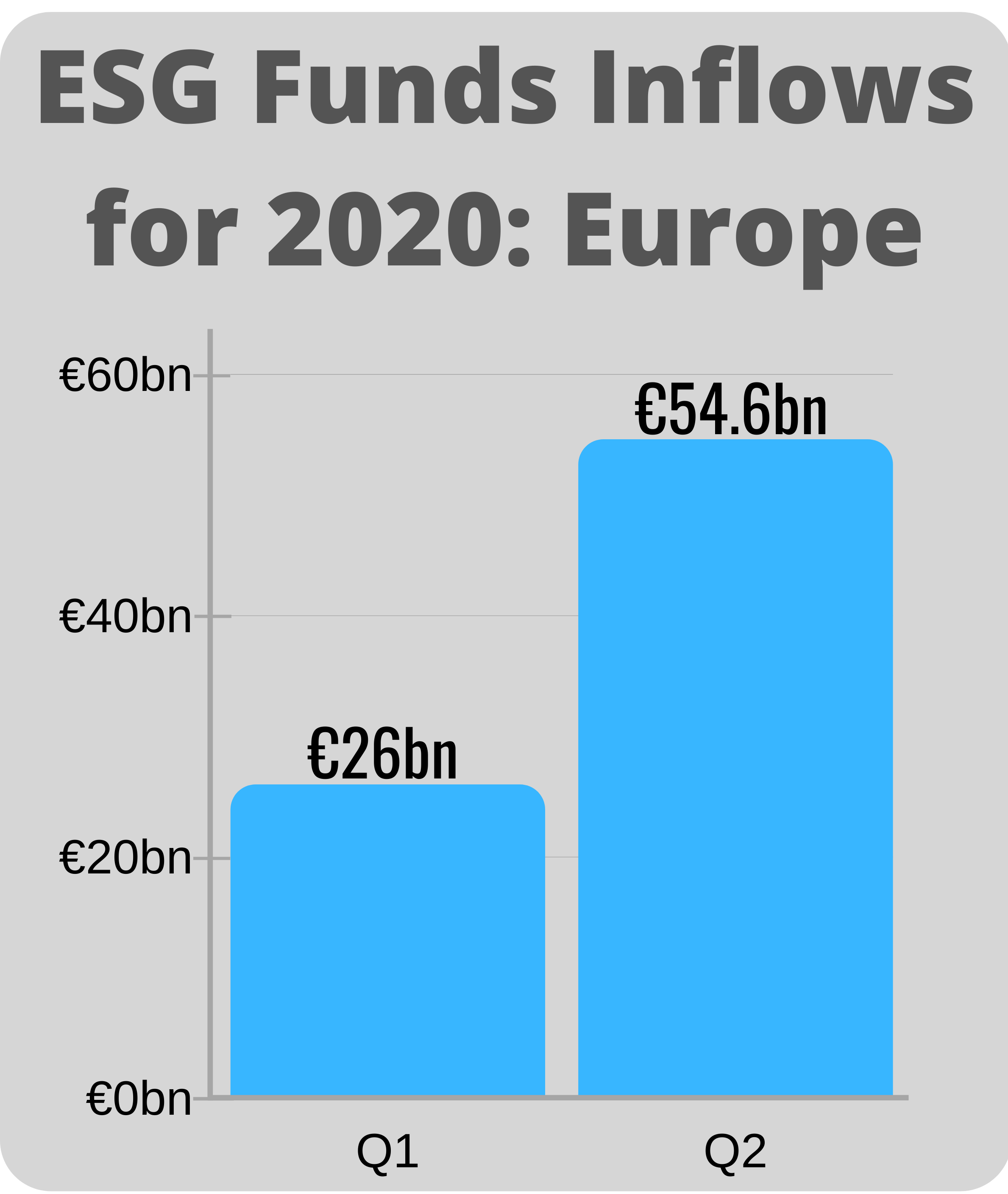

In fact, according to Deloitte partner François-Kim Hugé, “Covid-19 was the first big test of ESG investing, and it proved equal to it: in the first quarter, sustainable funds worldwide saw inflows of $45.7 billion, while the fund industry as a whole saw outflows of $384.7 billion.”

Alain Mandy, chief operating officer for funds at Wellington Management, says demand from institutional clients has accelerated this year for greater clarity on the sustainability of investment portfolios and for screening solutions.

However, he says the industry will be tested by new disclosure requirements due to a lack of consistency in rules among EU countries, differences among sustainability data providers and the idiosyncrasies of investors own preferences.

Industry members had become increasingly concerned about the March 2021 deadline for compliance with the EU’s Sustainable Finance Disclosure Regulation, requiring asset managers to report on their sustainably risks.

The measure has been billed as an important tool to combat greenwashing. At the conference, Luxembourg Stock Exchange deputy CEO Julie Becker urged that the compliance deadline should not be postponed, “even if we accept that the first batch of disclosures will be imperfect”.

But the European Commission has now indicated that while the legislation will still take effect on schedule in March, asset managers will have more time – potentially until 2022 – to comply with the disclosure requirements, in part because Covid-19 considerations have pushed back finalisation of the detailed rules.

Investor confidence on sustainable funds’ performance

Nevertheless, Sean O’Driscoll, Universal-Investment’s country head for Luxembourg, says the trend is inescapable: “No onboarding of new clients takes place without discussions on ESG.”

That’s down in part to increasing confidence among investors that sustainable investment doesn’t entail a penalty in performance; indeed, growing evidence shows that incorporating ESG into strategies can actively enhance returns.

And, says Commerz Real head of impact investing Tobias Huzarski, that doesn’t take into account the broader costs of businesses such as fossil fuel extraction and energy generation borne by society as a whole: “If non-sustainable activities had to internalise their environmental and social costs, their returns would be much lower.”

According to Peter Veldman, head of fund management for EQT Partners, sustainability today is an integral element of the private equity industry’s investment process and operations: “It’s not just about a particular investment, but everything we do. Businesses that resort to greenwashing will be gone before long.”

Change is fast

Karim Khairallah, a portfolio manager at distressed debt specialist Oaktree Capital Management, agrees:”It’s critical to have sustainability in a firm’s DNA. A lot of it is common sense – we were previously 95% there already, but now we have processes in place to manage and monitor compliance, and to identify and fix issues at portfolio companies we acquire.”

Industry members say the speed of the shift toward sustainability is particularly striking.

Jamie Broderick, a former JPMorgan Asset Management managing director and now a board member of the non-profit Impact Investing Institute, argues that the advent of Covid-19 has shifted the focus from exclusively climate change to a broader range of environmental and social issues – for example, how to achieve a ‘just transition’ to a low-carbon world.

Broderick told the ALFI Rentrée audience that sustainability is “unfolding faster than anything I’ve ever seen in asset management. We used to think of sustainability as something philosophical, emotional or ideological, but if you follow the money, the flows of capital show it’s a challenge for managers whatever their personal stance.”

If you’re interested in sustainability, finance, and the funds sector, you should read: