A pioneer in listing the first green bond in 2007, the Luxembourg Stock Exchange has become the world’s leading platform for investment in sustainable securities and launched the ground-breaking LGX listing platform in 2016. Now, says CEO Julie Becker, the exchange is moving to address obstacles to the growth of sustainable finance such as lack of investor and market education and the need for structured data.

What prompted the Luxembourg Stock Exchange to pioneer sustainability in the financial sector more than a decade ago?

The Luxembourg Stock Exchange has been active in sustainable finance ever since the European Investment Bank issued what is known as the world’s first green bond in 2007, which was listed on our exchange. The World Bank followed the following year, bringing its pioneering green bond to Luxembourg. These and other factors helped us understand early on that finance needed to become part of the solution to our global challenges and that sustainability had to become a natural part of finance.

But what really motivated us to establish the Luxembourg Green Exchange (LGX) in 2016 was the United Nations Sustainable Development Goals and the Paris Agreement. We wanted to contribute to these global ambitions, and decided to focus our efforts on reorienting capital flows toward sustainable investment projects. Through the LGX, which is the world’s leading platform for sustainable securities, we help unlock sustainable capital and accelerate the transition to a low-carbon and more inclusive economy.

How has the Luxembourg Stock Exchange won the confidence of major issuers such as the World Bank, International Finance Corporation, European Investment Bank and, more recently, the European Commission?

The Luxembourg Stock Exchange is the reference venue for the listing of sustainable securities, in particular green, social, sustainability and sustainability-linked bonds, and we welcome issuers from a range of different sectors, including leading development banks and supranational institutions such as the European Commission.

There are many reasons for this, notably our focus on transparency. Issuers that display their securities on the LGX need to comply with internationally recognised standards for sustainable securities and commit to stringent disclosure and reporting criteria, both before and after issuance. We make all relevant documentation available free of charge on our website, enabling investors to make informed investment decisions and to verify that issuers deliver on their commitments. Thanks to these eligibility requirements, the securities displayed on the LGX benefit from significant visibility.

Given our leading role in sustainable finance, we are widely recognised for our expertise in the field. We combine our sustainable finance knowledge with our 90-year history and experience in the listing of debt securities, and this creates trust and confidence among our issuers. Moreover, Luxembourg benefits from a triple A rating and offers a stable, and healthy economic and political environment, which has nurtured a diverse and dynamic economic ecosystem and strengthened its financial centre overall.

How would you assess the impact of the Luxembourg Green Exchange platform since its launch in 2016?

It was a bold decision to establish the LGX five years ago. Sustainable finance was still in its infancy, and we didn’t know how the market would react. But the response was and has remained extremely positive. In May this year, we welcomed the 1,000th sustainable bond to be displayed on LGX. Reaching 1,000 green, social, sustainability and sustainability-linked bonds within five years of launch is a tremendous achievement, which – I will admit – exceeds our most optimistic expectations back in 2016.

Over the past years, the LGX has made a significant contribution to the sustainable finance agenda on many fronts, but primarily in its product scope. What started as a platform exclusively for green bonds has grown to reflect and support sustainable finance market developments. In 2017, we expanded the scope to include social and sustainability bonds, and the following year we added green, social and ESG funds; last year we included sustainability-linked bonds. This illustrates how we move with and for the market, to support the growth of sustainable finance.

We have also increased our focus on data, which is a key driver of investor interest. Through the LGX DataHub, we offer asset managers and investors access to an ever-increasing range of structured sustainability data. With up to 150 data points for each security, this is the most comprehensive source of data on sustainable debt securities currently available.

Since education is another key driver of sustainable finance, we established the LGX Academy to increase knowledge and understanding of the field among market players. In this way, we are contributing to closing the knowledge gap, which is a significant barrier today. We also put a lot of effort into sharing our unique industry expertise, actively participating in multiple working groups at both national and international level to help shape best market practice and feed policy developments.

All these factors were recognised by the United Nations when we received the UN Global Climate Action Award in 2020. This was an exceptional milestone and recognition for our teams, and further strengthened both our conviction that we have set the right priorities and our determination to continue to contribute to the SDGs through financing of the real economy.

Has the growth of the sustainable securities market been restricted to some degree by the lack of common definitions on what constitutes green and socially responsible investment? Can the EU’s Taxonomy Regulation fill this gap?

It is true that the lack of universally accepted definitions, standards and reporting frameworks may be an issue, and is certainly deterring some issuers and investors from considering sustainable securities. However, there is a great deal of effort from active market players and organisations such as the International Capital Market Association to draw up principles and guidelines. Its Green Bond Principles, for example, were already established seven years ago.

The EU Taxonomy Regulation is a very positive development, as it helps to clarify what economic activity contributes substantially to one or more of the six environmental objectives, including climate change mitigation and adaptation, while ensuring that they do no significant harm to any other objectives. In this way, the taxonomy will provide a common framework, which is essential to ensure investors can contribute to meaningful and measurable environmental impact through their investments. It helps them make informed decisions and certainly contributes to increasing green investment.

Reaching an agreement on the EU Taxonomy proved, however, to be a difficult exercise and this goes to show just how complicated it is to establish one definition everyone can agree on. It is also important to note that the EU Taxonomy currently covers only part of the environmental aspect and that, for instance, a social taxonomy would be needed to create a common definition of what activities can qualify as social investment.

We have also witnessed an increasing number of taxonomy initiatives outside the EU, in countries including China, Canada, Malaysia and Indonesia. To avoid fragmentation of approaches and definitions, ensure the integrity of the market, and create trust and make sustainable finance instruments understood by investors, it is important to analyse, map and eventually harmonise all these taxonomies.

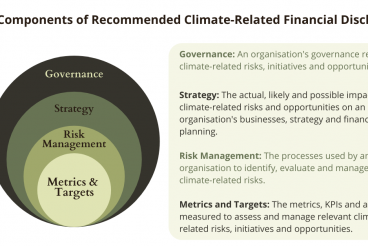

In addition to commonly agreed definitions, there is also a need for standards that facilitate comparability and ensure high-quality disclosures by financial market players. A lot of effort is currently going into addressing this issue, and there are many positive developments, such as the Task Force on Climate-Related Financial Disclosures, the Sustainability Accounting Standards Board, and IFRS’s ongoing work on sustainability reporting. At EU level, I would highlight the importance of the Sustainable Finance Disclosure Regulation and the recent proposal from the European Commission for a Corporate Sustainability Reporting Directive, amending and replacing the Non-Financial Reporting Directive.

How is the exchange working with international groups and organisations such as the Climate Bonds Initiative to develop the sustainable securities market?

We are working closely with the Climate Bonds Initiative and have supported several of its surveys and market insight reports in the past. Many of our issuers use the Climate Bonds Standard as a reference for their green bond issuance. This year we took our collaboration a step further by establishing the Climate Bonds-LGX Climate-Aligned Issuers section. This new initiative on the LGX complements the existing product section dedicated to sustainable bonds, and highlights companies that derive at least 75% of their revenue from climate-aligned activities. This new section enables investors to identify untapped opportunities in the wider climate-aligned investment universe beyond labelled bonds.

Issuers to be included in the Climate Bonds-LGX Climate-Aligned Issuers section are identified by the Climate Bonds Initiative through an in-depth screening process, research and detailed analysis of revenue streams, business activities and outstanding debt, and that list their securities on our exchange. At this stage, the section comprises 25 issuers, representing 176 issues from 16 countries. Given the lack of supply of labelled bonds, we believe it is important to spotlight other sustainable investment instruments that may be less known to investors and broaden their investment scope.

In recent months, the Luxembourg Stock Exchange has launched sustainability-related initiatives such as the Solactive LGX Green Bond Impact Index, LGX DataHub and LGX Academy. What is the strategy underpinning these new developments, and what further plans do you have in the pipeline?

Indeed, last year was a pivotal one for the LGX, as we started to offer solutions to address what we identified as some of the main hurdles to the growth of sustainable finance, namely lack of education and structured data. We established the LGX Academy in May 2020 to enhance sustainable finance knowledge and education, through the academy, our experts provide courses to financial sector professionals and students on sustainable finance principles, labels and standards, products and regulation. But most of all, they offer practical case studies and examples of what we observe at the LGX, enabling participants to understand the impact on their daily business. So far our lecturers have trained 170 individuals and the feedback is excellent.

Last September we launched the LGX DataHub, a centralised database of structured sustainability data now covering more than 3,200 sustainable bonds – close to the entire universe of listed sustainable debt securities worldwide. The LGX DataHub makes it possible for investors and asset managers to understand fully and compare the social or environmental impact of different securities and provides the data they need to develop sustainable investment strategies and report on these investments. Finally, we launched the Solactive LGX Green Bond Impact Index in November to offer investors a meaningful benchmark to track the performance of green bonds.

These initiatives reflect our focus on accelerating sustainable finance. We will continue to develop the LGX Academy and LGX DataHub in the coming months, as education and data remain at the top of our agenda. In terms of plans, we are working on developing other data-related services, as we are convinced data will play an increasingly important role in financial markets in the future. We are also analysing how best to support issuers in their transition to more sustainable models, since a complete, credible ESG profile will become a precondition for accessing capital markets at some point. Exchanges have a crucial role to play in this process.

At what point do you expect sustainability to be the default position for securities issuance?

If we are to achieve these global goals, we need to mobilise massive amounts of capital and channel capital flows into investments or companies with a positive social or environmental impact. Public funding will not be enough – we need to mobilise private investment.

I believe finance will become sustainable by default when all companies and institutions have adopted a sustainability strategy and clear goals, and become environmentally friendly in their revenue and operations. Once that is the case, all financial instruments issued by these companies and institutions can be considered sustainable by default.

That said, getting there will take considerable effort and commitment and requires real and meaningful action as well as a major change in attitudes and behaviour, from governments and companies, but also at an individual level. We welcome the renewed focus on sustainability that we have seen in recent years and the increasing sense of urgency in tackling climate change and social injustice. This new awareness is reflected in commitments by governments, in how investors allocate their money, and in how companies are speeding up their transition.

We are on the right track, but let’s not forget that sustainable finance is still a small part of the industry as a whole, and we need to set ambitious sustainability goals for all industries. Capital markets need to become more sustainable and inclusive, serve the real economy and contribute to creating a fairer world for everyone.

— — —

Julie Becker has been at the helm of the Luxembourg Stock Exchange (LuxSE) since April, 2021. She joined LuxSE in 2013 and was appointed to its Executive Committee in 2015, before being named Deputy CEO in 2019, and CEO two years later.

Her career in the financial sector in Luxembourg spans over two decades and includes positions at the Central Bank of Luxembourg and Dexia. In 2016, Julie Becker founded the Luxembourg Green Exchange (LGX), the world’s leading platform for sustainable securities. A recognised expert in the field of sustainable finance, Julie Becker has represented LuxSE and LGX at numerous, international expert forums and conferences over the past years, including at the prestigious EU High-Level Expert Group on Sustainable Finance from 2016-2018. She is also the Chair of LuxCMA, a capital markets industry association established in 2019.