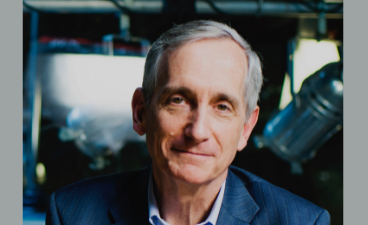

Interest in ESG funds is growing as the climate crisis makes an ever-greater impact on people and property around the world. In a revealing interview with VitalBriefing – the first in our Sustainability Matters interview series – Dr. Kim Schumacher, Lecturer in Sustainable Finance and ESG at the Tokyo Institute of Technology, assesses the financial community’s ability to meet this demand for responsible investing. From Schrodinger’s Cat, which may or not be alive, to organic tomatoes, his analysis offers no comfort to asset managers nor their clients.

Why are ESG funds becoming so popular among investors?

I think there are three drivers behind this:

There’s a societal shift in that climate and environmental issues are coming to the forefront as their impacts become more material every year. An iceberg breaking off seems very remote, but the bushfires in Australia and the recent freeze in Texas is bringing it home in G20 countries. Initiatives like Greta Thunberg’s “Fridays for Future” have also raised awareness, and so has the Covid-19 pandemic.

Secondly, there’s a regulatory driver as lawmakers react to the demands of constituents who are becoming more vocal in demanding action from their politicians, which in turn affects policy.

Finally, there’s an economic impetus, because finance industry portfolios are now at risk due to pressure from the two other drivers: Supply chains are being affected by climate-related impacts, which are becoming more frequent and unpredictable, while changes in regulations and policies are also having an effect.

Does the investment community have the expertise to meet this demand?

My answer is a resounding ‘no’.

The finance industry is in a transition from assessing financial risks to including non-financial ones. Their analysts don’t have experience handling biodiversity data or water chemical studies, but these are suddenly becoming material to financial decision-making. A finance person can’t quickly become a climate scientist or a biodiversity expert.

So, you have a choice of taking the long road or the quick fix — and a lot are choosing the latter in the form of a quick online course.

There is growing evidence to show that so-called ‘ESG experts’ simply are not. I reckon that 90% of ESG heads in companies have been with their organisation for many years, or may have a big name, but don’t have any material expertise that would inspire confidence.

Many firms and investors rely on ratings agencies because they boil ESG performance down to a letter or a number. But agencies often don’t provide concrete details about their methodologies – only indications.

It’s like Coca-Cola: they tell you what’s in the drink but not the exact formula because that’s proprietary. But it means you cannot know if an agency has properly included climate-related exposure or heat-stress factors, for example.

What, then, should the investment community do to remedy that?

Two things need to happen.

The first is capacity building, in different ways. We need to train more finance people in ESG but we need to also understand the limitations of that training. Awareness and passion about ESG are not the same as subject matter expertise. Just because I’m passionate about first aid doesn’t make me a doctor.

Financial institutions need to start bringing in natural science experts and giving them some financial knowledge so they can create mixed teams that cover financial and non-financial aspects.

Not every institution has the need or budget for a climate science department. But you can also access that expertise by working with research institutions and universities, either directly or through a regional finance industry group, for example.

Secondly, financial institutions need to realise that we are often dealing with natural processes and regeneration cycles which need to be respected — and that takes time and money.

A forestry fund’s claims about locking in carbon, maintaining biodiversity or being more resilient to pests or drought all take time to prove. You can only get so much data from satellites; at some point, you have to go and collect soil samples.

And as these are externalities that people don’t want to pay for, a lot of things that ESG requires are often not carried out and a lot of data is therefore missing. But without proper data and verification in place, it’s not ESG. It’s ‘greenwashing.’

How do you define greenwashing and how can new EU legislation tackle it?

For me, greenwashing is the intentional or inadvertent misrepresentation of your capacity or desire to measure, report or verify ESG-related impacts. It’s a claim with no data. You could call it Schrodinger’s Claim, because if there is no disproving it, the claim could be true and not true at the same time.

So, the only solution is oversight and enforcement.

Now, the EU Taxonomy and Sustainable Finance Disclosure Regulation (SFDR) are a step in the right direction but there are problems with both. Regulators in some EU countries have said that companies can self-verify their compliance with the SFDR Phase 1 because the regulators don’t have the capacity to monitor any of the claims made by funds and their sustainability-related aspects.

Also, the chances of being penalised for non-compliance are minimal, and the penalty itself is not proportionate to the violation. And like the SFDR, the EU Taxonomy also needs to be enforced. What’s the point of a taxonomy regulation if it’s wrongly applied and there are no consequences?

Who is responsible for this situation?

Clients are partly to blame because they don’t want to pay for quality services, while investors and asset managers are also to blame because they just respond to what clients want to hear, which is that they can have the same alpha performance and be sustainable.

Then you have regulators in countries like the UK, Ireland and Luxembourg who want to attract more green investment to their hubs so they can scale their own ESG sector.

It’s a perfect combination for a green bubble.

But investors can’t have their cake and eat it. They want the same alpha performance; they want green; and they don’t want to spend more to prove that it’s green.

Those three things just do not work; they are not possible. And the financial sector is complicit because they don’t want to lose business.

So, putting all that together:

- Financial people have no idea about non-financial data.

- Data providers do not reveal their methodologies and rely on self-declared company data that is very incomplete and not properly verified.

- Most so-called ESG experts have only done a short course

- Regulators cannot properly monitor and enforce regulations.

As an investor, I would be very worried about this situation.

So, does ESG actually exist?

Right now, for me, there is no ESG.

If funds don’t provide enough data to prove they have a tangible impact on non-financial performance metrics, how can we even prove there is a workable system of sustainable finance?

We’re just not doing the job. Because no one wants to admit that ESG requires a radical shift in terms of what to expect in financial returns, then you can’t expect the same level of alpha from ESG investments.

It also requires a radical shift in what we qualify as performance for the non-financial aspect. We need to start putting a price on non-financial performance. For example, good data and transparency should be an indicator and should be rewarded.

We also need to value other, incremental changes. Organic food is a good example. You need to value two organic tomatoes as you would 10 conventional ones, i.e., by having the same price. You have to accept you will only get two, in return for all the environmental benefits that are encapsulated in those tomatoes. And I think we have to accept that principle in the finance industry too.

Do you need to stay on top of ESG and sustainable finance news? Check out the Sustainable Finance News & Insights Briefing, bringing you news summaries and market analysis on regulation, legislation, investment trends, products and more.

Produced by expert financial journalists, it cuts through the confusion, saving you time by delivering everything you need to know in one monthly newsletter.

This article is from VitalBriefing’s Sustainability Matters content series, in which we speak with experts across every facet of sustainability, ESG, sustainable finance, impact investing and more. If you or a colleague are interested in participating in the series, please get in touch by emailing eschrieberg@vitalbriefing.com.