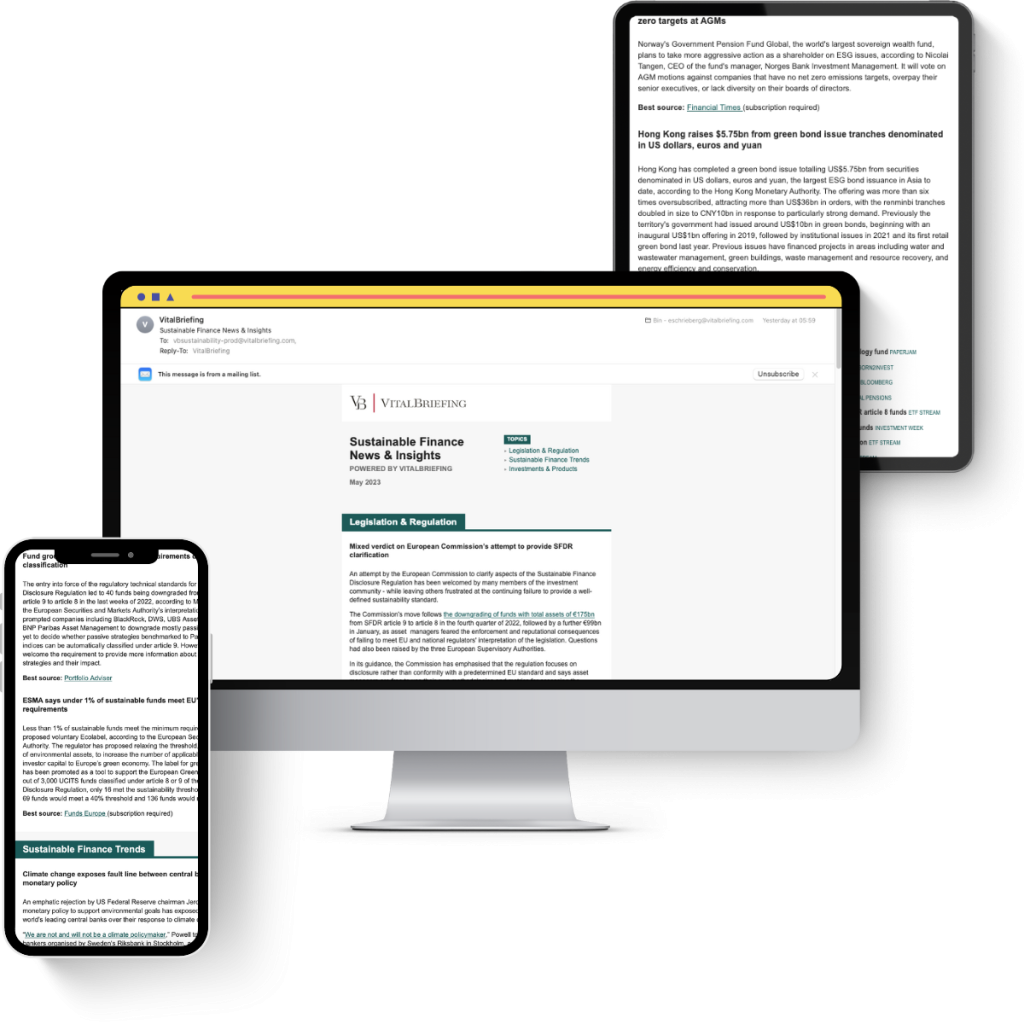

Market and Competitor Intelligence Briefings customised for you by an expert global editorial team

Fully customised Briefings for your business

- VitalBriefing tracks, distils and converts the overload of news and developments about your industry, competitors and markets into actionable insights and intelligence

- Tailored to your needs and priorities, summaries feature high-value market intelligence for any target audience — from decision-makers and staff to clients and prospects

- The most advanced tools in AI and search leveraged by an experienced editorial team

- Each summary fact-checked for accuracy

- Briefings can be white-labelled with your branding

Cut through the clutter

The world is moving fast — and faster. How do you stay on top of the news and intelligence impacting your organisation? Our bespoke Market Intelligence Briefings identify valuable opportunities and competitor threats with the real-time, high-value insights you need.

Inside the VitalBriefing Newsroom

70+ journalists and editors with knowledge and expertise in delivering critical insights that drive business decisions

Proactive service that assesses your Briefing’s audience engagement data, including recommendations to ensure its impact and relevance

Objective subject experts, driven by journalistic integrity, comprehensively covering and monitoring your stakeholders’ priorities and interests

A global editorial team with a deep understanding of news & developments impacting any market, led by a Pulitzer-prize winning journalist

Need to produce written content that engages clients and prospects?

VitalBriefing’s veteran team of editors and journalists create engaging copy displaying your brand. Showcase your compelling thought leadership through blogs and articles, in your voice, written by industry-expert journalists and tailored to your business goals.