Sustainability is fast-becoming a key focus in asset management. Last week’s ALFI London Conference was full of great online discussions and fascinating insight from speakers on key related topics, from Brexit to fund regulation to fiscal and monetary policy to the impact of Covid-19. Here’s a report we put together as media partners for ALFI‘s event. Take a look at their site to see if you’d be interested in any of their upcoming virtual conferences.

Shaping the fund industry’s future: Covid-19, sustainability – and Brexit

With negotiations on a future trade deal between the European Union and the UK government seemingly on tenterhooks, Brexit cast an understandable shadow over ALFI’s annual London Conference on November 23, a virtual event that attracted around 1,000 registrations. Speakers such as ALFI chairperson Corinne Lamesch emphasised, however, that the close relationship with Luxembourg’s asset management sector is destined to endure: “We will continue to work together with UK fund sector whatever the outcome of the trade talks.”

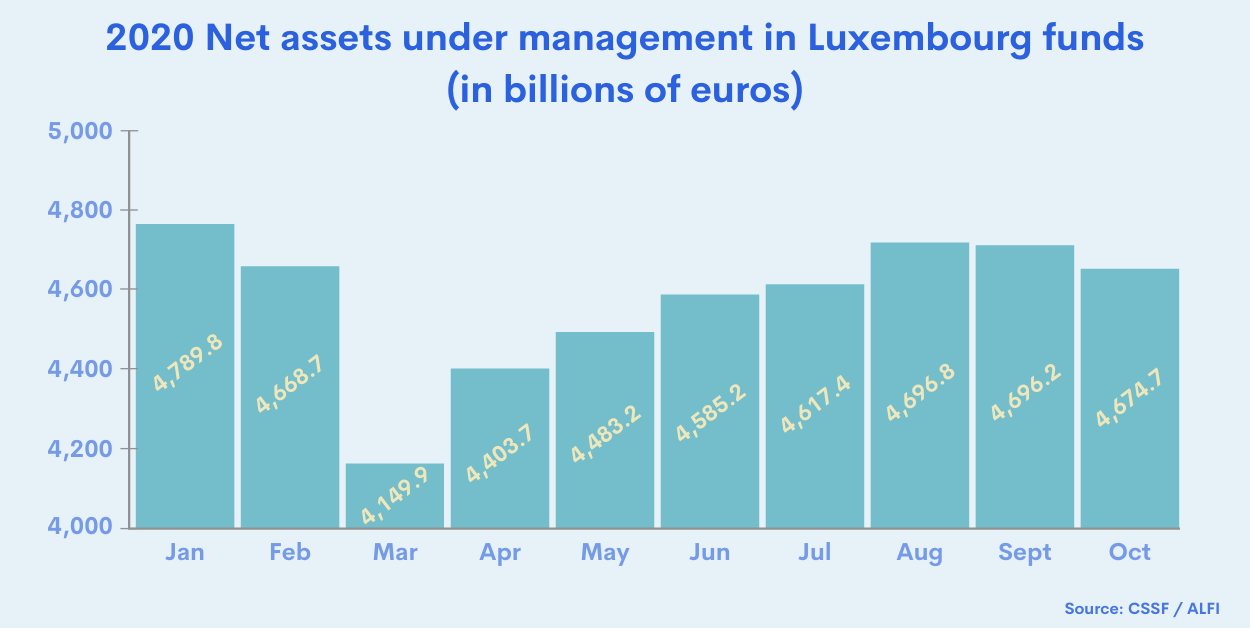

The Covid-19 pandemic may have shaken up working patterns, changed the economic environment significantly and influenced investment strategy trends, but so far it has not dented the sector’s positive outlook. Lamesch noted: “Luxembourg’s fund industry has demonstrated its agility and resilience – after an 11% drop in March, assets have rebounded to close to their January record high.”

Finance minister Pierre Gramegna says Luxembourg has a more interdependent relationship with the UK than other European countries. “Brexit is not on the minds of many EU policymakers, but I am an exception,” he said, noting that Luxembourg has been well placed to help UK financial businesses adapt to the new legal environment: “We have had four years to prepare for the end of passporting and the need for UK institutions to create an EU presence. And we see a trend toward use of Luxembourg law for bonds because it is close to English common law and offers both flexibility and legal certainty.”

Rebuilding bridges

While industry members believe an agreement that will minimise disruption for the financial industry should be possible, they warn that deadlock could lead to a damaging loss of trust. Said Luxembourg for Finance CEO Nicolas Mackel: “The election of Joe Biden is a game-changer tipping the balance toward a Brexit deal, reducing the risk of the UK slamming the door, but the time left for implementation is getting short”.

“A Brexit deal is important to the financial services industry because it will change the atmosphere between Britain and the EU. Without a deal, acrimony could last for a couple of years, and it would be more difficult to rebuild bridges.” Mackel was echoed by Schroders’ head of public policy Sheila Nicholl: “We need trust and co-operation, and without a Brexit deal that will take time to rebuild.”

Chris Cummings, CEO of the UK’s Investment Association, added: “We need a permanent structured dialogue with the EU to share ideas, compare notes, and ensure no unwelcome surprises.” But head of European compliance Christopher Dearie says private equity firm Apollo Management is worried about national differences within the EU that could undermine single market opportunities even for firms which, like Apollo, have established substantial operations in EU jurisdictions to prepare for Brexit.

Overseas Funds Regime

In the meantime, regulators are adapting to the separation of the UK from the EU single market rulebook. Nick Miller, head of asset management supervision at the UK’s Financial Conduct Authority, says the regulator is drawing up an Overseas Funds Regime as the long-term successor to the FCA’s temporary permissions regime to prevent short-term market disruption.

“Our aim is to maintain high standards but to be open to partners in the EU and elsewhere to offer retail funds in the UK,” Miller said. “The onshoring of EU rules will stop because we need to ensure our regulation is appropriate for the UK market. We will develop a UK green taxonomy, which may not be exactly the same as the EU’s, but will target similar outcomes.”

CSSF head of funds supervision Marco Zwick, meanwhile, is focusing on the implementation on March 10 next year of the EU’s Sustainable Finance Disclosure Regulation. “The SFDR will be a big challenge for the sector and for regulators, and everyone will have to move fast. We are defining a fast-track process for prospectus updates, because the EU rules give no leeway on the deadline.”

Tectonic shift toward ESG

SFDR compliance is just one aspect of the challenge facing the asset management industry in incorporating sustainability into its strategies and operations. “We need to show clients we care about sustainability and to translate that into investment decisions,” said Aviva Investors’ global head of product strategy Steven Blackie.

“There has been a tectonic shift toward ESG, which now underpins every investment strategy in a way not seen two years ago, and we’re only scratching the surface.” This could affect the industry in less obvious ways: “As investors demand environmental and social outcomes, this could tip the balance back from passive toward active management.”

Fidelity International CEO Anne Richards points to the problem of a lack of consensus on sustainability standards and definitions. “I’m less worried about greenwashing than about confusion over what constitutes green investment,” she said. “Managers are having to figure out what’s right – for example, some advocate engagement with fossil fuel companies to effect change, while others simply exclude them. We need comparable and consistent criteria and measurable characteristics. At present there are so many different taxonomies – what we need is something that looks like accounting standards.”

Fiduciary duty

Schroders’ head of Europe Karine Szenberg is confident, however, that the trend is unstoppable, and it implies a new role for asset managers. “Sustainability and stewardship are completely interconnected,” she said. “Initially the focus was on governance, but environmental and social impact are now equally important. Today unsustainable businesses and sectors have nowhere to hide.”

That’s reflected in the surge in demand for sustainable products from investors; a recent PwC study forecast that ESG considerations could drive up as much as 50% of all European fund assets by 2025. James Broderick, a board member of the London-based Impact Investing Institute said: “Growth of 30% a year should be an opportunity, although for asset managers that are not ready it represents a threat.”

The shift toward sustainable investment may have been slowed by a narrower definition of fiduciary duty in the UK and US, which excludes non-financial considerations, than in other European countries. But European Investment Bank senior adviser Nancy Saich believes this may be about to change – especially with the change of administration in Washington. “A World Economic Forum report at the beginning of this year found that the biggest global economic risks were all related to the environmental and climate,” she said. “Not to embrace sustainability means ignoring major risks.”

Fund service providers face other changes to the business environment. “Both we and our clients are under pressure on costs, regulation and disruption around data technology,” said BNP Paribas Securities Services managing director Robert van Kerkhoff. According to senior vice-president Eduardo Gramuglia, the pandemic has accelerated strategic changes at State Street Bank International to adapt to new cost imperatives and the evolution of asset classes and products.

Tailor-made offerings

Asset managers, meanwhile, must take into account increasingly differentiated customer needs. Micaela Forelli, head of European distribution at M&G International Investments, says demand can no longer be served by a single fund or range but an ad hoc and niche approach. Amundi business development manager Etienne Lombard added: “Ultra-high net worth individuals with whom you have to listen to their needs – it’s no longer prêt-a-porter but haute couture.”

Independent consultant Peter Grimmett says that in some areas, policymakers need to do a better job. “The industry was very supportive of the European Long Term Investment Fund regime, but what came out was slightly different,” he said. “ELTIFs were to offer regulation and access to retail clients, but the retail rules were tough – so it was easier for asset managers to launch AIFs instead. The basic Pan-European Personal Pension product came with a 1% maximum charge including advice fees, which was very difficult for active asset managers. Changes are needed to make these regimes fit for purpose.”

These developments are taking place just as economic policy fundamentals are undergoing their biggest change in three decades, according to Citi chief economist Arnaud Marès. “The 30-year separation of monetary and fiscal policy is probably over,” he told conference participants. “Economies will continue to need huge government support until a Covid-19 vaccine is rolled out.”

Meanwhile, monetary policy is no longer working as it’s supposed to, he says; even with interest rates at zero, or negative rates, people are convinced they need to save rather than spend. “In addition, governments that have borrowed hundreds of billions of euros need to know that central bank support will not be suddenly taken away. In this new world, central banks have no choice but to ensure interest rates and yields will remain close to zero for a very long time.”

Interested in sustainability, finance, and the funds sector? We think you’ll like: