Fintech is not about the future of the financial industry – but its present.

Fintech is not about the future of the financial industry – but its present.

Online and mobile banking is no longer futuristic, but what’s expected of any institution, from venerable financial dynasties to upstart challengers.

Instant payments, smartphone transactions, crowdfunding and savings apps have moved from the disruptive fringe into the mainstream. Confined just a short time ago to the world of start-ups, today’s fintech firms just as likely could be well-established businesses recording swelling profits and paying handsome dividends to shareholders.

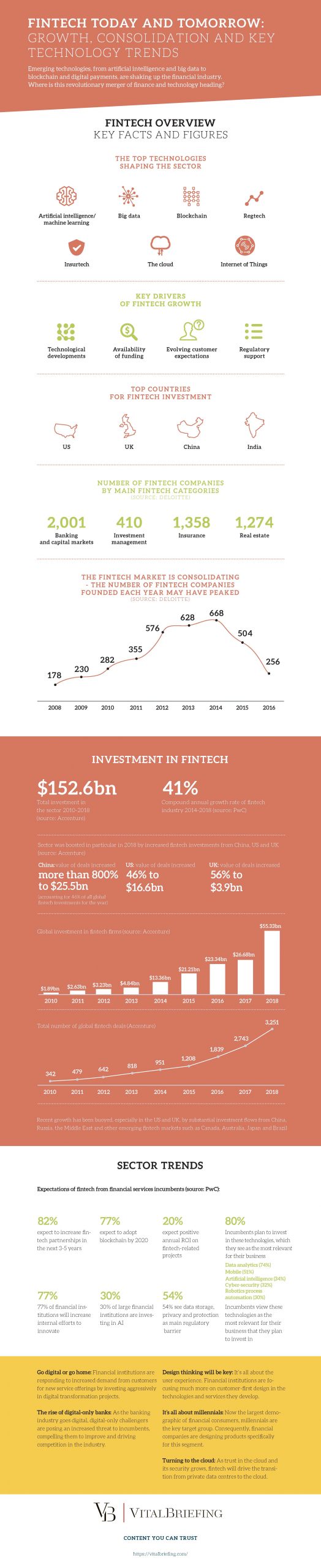

After years of steady rather than breakneck growth, investment in the sector may be growing faster than ever: New money doubled to $55 billion last year alone compared with a total of $153 billion in the eight years between 2010 and 2018. Almost half came from China ($26 billion), although the US and the UK, despite Brexit, remain significant sources of venture capital and other types of investment.

Fintech firms are becoming bigger – much bigger – but there are fewer of them: the number of start-ups founded worldwide peaked at 668 in 2014 and in 2016 was down sharply to 256.

While still a hotbed of innovation, that’s a sign of a sector starting to mature. A few years ago, the industry’s most high-profile firms were focusing on, among others, mobile transactions, digital payments, and above all crypto-currencies and blockchain, the distributed ledger technology underpinning bitcoin.

Today the headlines are more about artificial intelligence, machine learning and big data as new applications try less to sweep away the traditional financial architecture and its incumbents than to carry out more cheaply, quickly and efficiently familiar functions such as customer due diligence or trade processing.

The traditional financial industry remains worried about the possible impact on its business of technology giants such as Google, Apple and Facebook moving onto their turf to exploit huge established customer bases.

For mainstream banks, insurers, asset and wealth managers, and their myriad service providers, fintech firms offer a source of new thinking not found in-house as well as technology to make them fit for purpose in the digital era.

For all their concern about the impact of disruptive technology on the stability of the financial system, even officials who might be considered champions of orthodoxy are looking for ways to encourage the flow of fintech innovation into the mainstream. Regulators’ digital sandbox schemes enable fintech firms to test and refine their products and services with live customers before they shoulder the full weight of regulatory compliance.

They’re also encouraging the fast-growing area of regtech, enabling digital technology to ease the ever-more-complex process of adherence to the additional rules that have besieged the financial sector over the decade since the financial crisis.

And even the world’s central banks, while they decry the instability, insecurity and lawlessness of crypto-currencies, are discreetly exploring the capability of digital money to smooth financial flows and anchor monetary policy-making.

In short, fintech may be moving beyond its Wild West phase but the digital transformation of the global financial framework is barely at the end of the beginning.